Startups and scaleups - Facts & Figures

Luxembourg has rapidly emerged as a dynamic hub for startups, combining a supportive business environment with strong international connections. This report presents key insights into the start-up ecosystem in Luxembourg up to the end of 2025.

Luxembourg’s startups and scaleups ecosystem at a glance

Luxembourg has rapidly emerged as a dynamic hub for startups, combining a supportive business environment with strong international connections. The government has complemented its “From Seed to Scale” roadmap with a bold 10-point action plan to strengthen financing, create sector-specific incubators, expand internationalisation programmes, and launch new measures to attract talent and incentivise private investment.

Moreover, the country offers entrepreneurs a unique blend of advantages: easy access to the European market, a highly skilled workforce, tailored support programmes and a vibrant community of innovators.

From fintech and space to healthtech, digital technologies and sustainability, Luxembourg’s startups are active across a wide range of sectors, reflecting the diversity and resilience of its economy. With dedicated funding opportunities, public–private collaboration and international investor interest, the startup ecosystem is progressing and helping shape the industries of tomorrow.

Here we explore the national startup and scaleup ecosystem. The information stems from an analysis conducted based on the Dealroom dataset of startups and scaleups active in Luxembourg and founded since 2005 (until 2025).

The startups and scaleups listed on the Dealroom database align with the following criteria: rapidly scaling/scalable entities, maximum 20 years old, innovative by design and active in Luxembourg (headquarters, founding place or a regular office).

To ensure comprehensive coverage, startups not yet listed on Dealroom are invited to create a profile and contribute to future ecosystem analyses (link to connect: Dashboard | Luxembourg Startup Ecosystem).

Growth over time

As of December 2025, over 800+ startups are part of the Luxembourg ecosystem, with 690 of them being headquartered in Luxembourg.

The ecosystem continues to expand, with 58 new startups launched in 2025. Half of the companies created in 2025 are leveraging artificial intelligence, reflecting a strong trend towards digital innovation, especially in enterprise software, health platforms and fintech.

For more insights on AI startups and scaleups, please check out our Luxembourg AI startups and scaleups ecosystem analysis.

Figure 1: Number of startups and scaleups in Luxembourg per creation year

Source of data: Dealroom

Global footprint

Luxembourg’s central location in Europe and its direct connections to neighbouring markets make it an ideal launchpad for international expansion.

As of December 2025, 224 startups and scaleups, representing 27% of the ecosystem, have established a presence beyond Luxembourg’s borders.

Luxembourg startups are globally connected, with strong ties across Europe, North America and Asia.

Most popular countries include the United States, France, the United Kingdom, Germany and Belgium.

Figure 2: Startups and scaleups with an international presence: breakdown by top 10 country

Source of data: Dealroom (a startup can be counted in several regions)

Most represented sectors

Enterprise software and fintech remain the most prominent sectors within Luxembourg’s startup ecosystem, highlighting the nation’s expertise in SaaS and B2B innovation. Health startups, including those in healthtech, pharmaceuticals and biotech, are also very well represented.

The energy sector, focused on clean energy and efficiency solutions, ranks fourth in terms of the number of active startups. The space and transportation sectors follow closely, with 57 startups each.

Looking at the growth of the leading sectors, energy has experienced remarkable expansion with a growth of 135% in the last five years, from 26 startups in 2020 to 61 active startups in 2025. Real estate, which includes the construction sector, has also seen substantial growth of 121%, increasing from 19 startups in 2020 to 42 today.

Curious about notable startups in major industries? Check out our success stories below!

Figure 3: Number of startups and scaleups by top 10 industries

Source of data: Dealroom

Funding landscape

Source of data: Dealroom

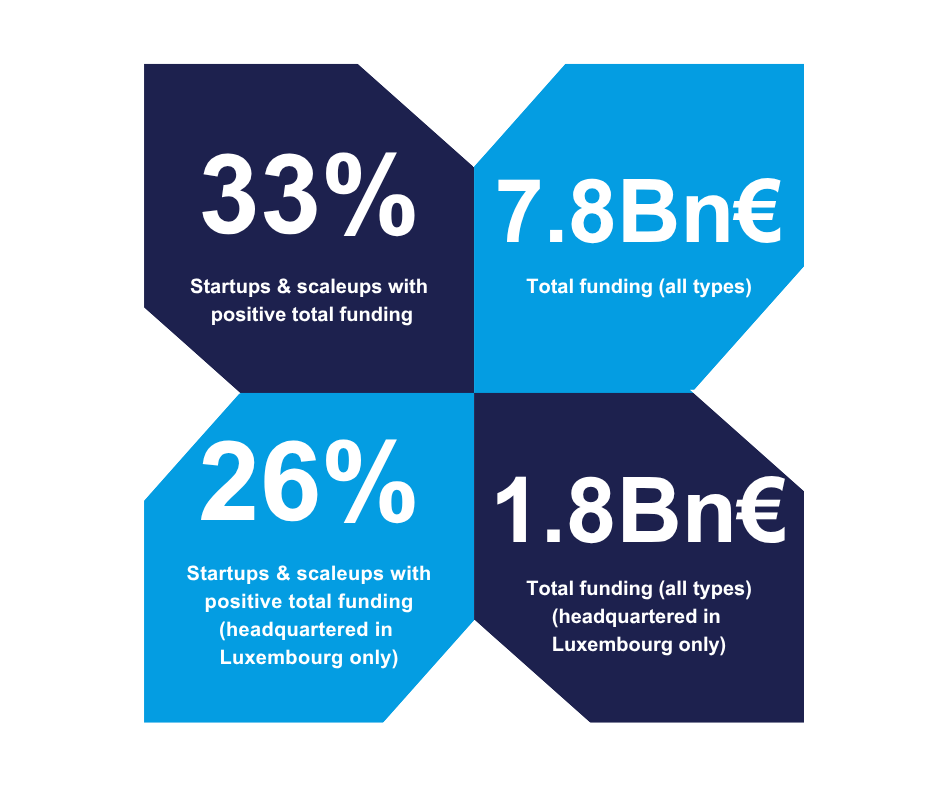

The Luxembourg startup ecosystem has steadily grown into a vibrant hub for innovation and investment. Since their creation, one in three startups (33%) have secured disclosed funding, bringing in a remarkable €7.8 billion across more than 980 funding rounds of all types.

If we zoom in on active startups headquartered in Luxembourg, the picture remains strong: 26% have attracted funding, showing the country’s ability to support home-grown ventures. These startups have raised €1.8 billion through more than 570 rounds.

Funding activity can be seen across both early and later stages:

- Early-stage funding remains dynamic: pre-seed to Series A rounds account for €1.1 billion across 548 rounds, with €600 million (356 rounds) raised by Luxembourg-headquartered startups.

- For larger rounds (Series B, C, and €100M+), there have been 92 rounds totalling €6.7 billion*, with 22 of these raised by entities headquartered in Luxembourg.

This distribution demonstrates both the ecosystem’s capacity to nurture early-stage ventures and its growing ability to attract significant later-stage investment.

*Note: some of the largest rounds are raised by companies registered in Luxembourg but with most operations abroad, which can influence aggregate figures.

Funding split by stage

Looking at the graph of startups by funding stage, the breakdown is as follows:

- 148 companies (18% of the ecosystem) have raised at least €1 million, signalling a strong cohort ready for growth.

- 115 startups (14%) are still at pre-seed, with less than €1 million raised, ensuring a healthy flow of fresh ventures entering the scene.

Among startups with disclosed funding, the average amount raised is €8 million, while the median is €150,000. This wide range highlights both the presence of high-growth outliers and a solid base of companies securing early-stage capital.

Figure 4: Number of startups and scaleups by current total disclosed funding size and headquarter

Source of data: Dealroom

Funding ratios in key industries

When it comes to funding, the space sector stands out for its high proportion of funded startups: 68% of space companies have secured investment.

As seen in the graph hereunder, the health sector also shows a strong funding ratio, with 38% of startups having attracted investment.

By contrast, enterprise software and security (including cybersecurity) startups have a lower share of funded companies, with only 27% having raised funds. This may reflect differences in business models, capital requirements or investor focus across sectors.

Figure 5: Top 10 industries: share of funded startups

Source of data: Dealroom (Only startups with positive disclosed funding are counted.

All ecosystem data, HQ and non-HQ in Luxembourg)

What happened in 2025?

In 2025, startups active in Luxembourg, including both locally headquartered and international companies operating in the country, have raised over €400 million, which represents a 52% increase compared to 2024.

Although the number of funding rounds has declined, with 75 recorded in 2025 compared to 107 in 2024, the average ticket size has grown significantly. This year, the average round reached €5.4 million, which is more than two times higher than last year’s average of €2.5 million.

Seed-stage funding remains the most common, with 20 out of the 75 rounds falling within the €1 to €4 million range.

Check out publicly announced fundings of the ecosystem here: Funding rounds | Luxembourg Startup Ecosystem.

Get inspired! Discover success stories from the ecosystem

- Space

- Health

- Enterprise software

- Fintech