Luxembourg healthtech ecosystem - Facts & Figures

Last update: September 2025

Luxembourg healthtech ecosystem overview

The Healthtech Facts & Figures document presented here is derived from the 2025 version of the Luxembourg healthtech ecosystem mapping.

It breaks down the data behind the 130 entities mapped, giving you the context and insights to navigate the landscape with clarity.

As a reminder, the scope of the healthtech ecosystem mapping includes private companies with technologies addressing the needs of the human health market (e.g. from technologies to enable personalised medicine - such as wearable devices for patient remote monitoring to improve chronic disease management - to apps for mental health support). Activities of healthcare providers (doctors, dentists, prosthetists, etc.) and those of the public sector (e.g. public biomedical research, public hospitals) have been excluded.

A diversified ecosystem

The medical devices and software sub-sectors are both strongly represented, accounting for 32% and 31% of companies in the healthtech ecosystem, respectively.

Companies classified as distributors represent 19% of the healthtech ecosystem. They specialise in delivering, among other things, medical devices and pharmaceuticals to healthcare professionals.

The other companies making up the healthtech ecosystem in Luxembourg are those in the subsectors of bio-pharma (13%), in-vitro diagnostics (2%) and clinical laboratories (2%).

Figure 1: Share of Luxembourg healthtech companies by sub-sector

Source of data: Luxinnovation (2025 Luxembourg Healthtech Ecosystem Mapping)

A young ecosystem

Luxembourg’s healthtech sector is still relatively young: over a third (36%) of today’s healthtech companies in Luxembourg have been established within the last decade.

More than half of these firms (representing 19% of the total number of companies) have been registered in the last 5 years.

Figure 2: Share of healthtech companies incorporated within the last decade

Source of data: Luxinnovation (2025 Luxembourg Healthtech Ecosystem Mapping)

Startup spirit and entrepreneurial momentum

A remarkable 35% of healthtech companies are startups and scaleups.

This entrepreneurial spirit is supported by national innovation strategies and public-private initiatives that aim to foster entrepreneurship and accelerate time-to-market for emerging technologies.

In fact, more than a third (36%) of the healthtech startups and scaleups have been supported by the Fit 4 Start acceleration programme.

Among the 45 startups and scaleups active in the healthtech ecosystem, a majority (85%) is active in the two sub-sectors of non-regulated health software and medical devices.

Figure 3: Distribution of healthtech startups / scaleups by sub-sector

Source of data: Luxinnovation (2025 Luxembourg Healthtech Ecosystem Mapping)

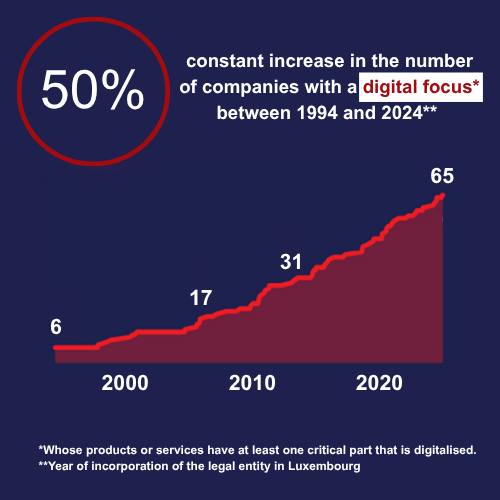

Taking advantage of digitalisation

As a result of the constant development that has taken place since the early 1990s, healthtech companies with a focus on digital technologies such as software applications, data analysis and emerging technologies like AI, machine learning and blockchain now account for 50% of the healthtech ecosystem in Luxembourg.

This mirrors the broader European trend of increased adoption of digital health technology by the human health market.

Figure 4: Evolution of the number of healthtech companies with a digital focus

Source of data: Luxinnovation (2025 Luxembourg Healthtech Ecosystem Mapping)

Deepening technological capabilities

Almost half (48%) of companies in the healthtech ecosystem are developing and/or using cloud & web, data science & analytics and artificial intelligence (AI) technologies.

The top technological specialisations in the healthtech ecosystem are cloud and web technologies, representing 46% of technology companies, and diagnostic & imaging, 29%.

Furthermore, 28% of technology companies specialise in data science & analytics. The artificial intelligence and digital interfaces & platforms categories each account for 26% of technology companies.

Marked by a significant presence of non-core healthtech companies, the categories advanced materials & manufacturing and connected sensing technologies are also well represented, with 18% and 17% of technology companies, respectively.

Figure 5: Key technologies and solutions developed / used by the Luxembourg healthtech companies (top 10 categories)

Source of data: Luxinnovation (2025 Luxembourg Healthtech Ecosystem Mapping)

.png)

.png)