Luxembourg has emerged as a vibrant hub for AI innovation, fostering a dynamic ecosystem of startups and scaleups that leverage artificial intelligence to drive technological advancements across various sectors.

Empowering national AI startups is part of Luxembourg’s broader ambition to lead in responsible and human-centric AI, as outlined in the Luxembourg AI Strategy. The strategy promotes a sustainable, data-driven economy by investing in AI skills, research, innovation, and ethical deployment.

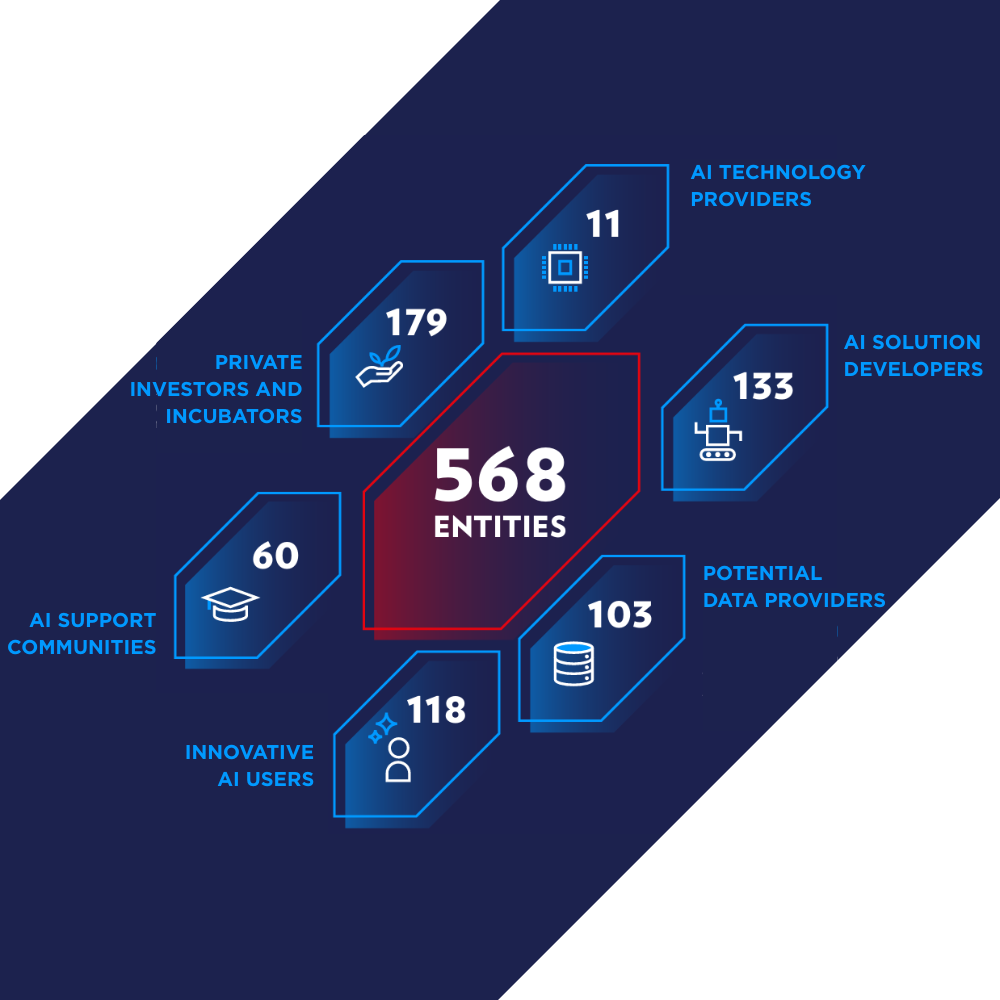

To complement this startup-focused view, the Luxembourg AI Ecosystem Mapping offers a wider perspective, including stakeholders ranging from startups, corporates, research institutions, public bodies, and support organizations across the national AI value chain.

This article explores the national AI startup ecosystem and was conducted at the beginning of July 2025, based on a dataset of startups and scaleups founded in Luxembourg since 2005. To be included, companies must offer a product that is based on, integrates, or develops artificial intelligence (AI) technologies.

The primary source of information is the public Dealroom database, which was cross-referenced with the AI mapping developed by Luxinnovation to ensure accuracy and completeness.

The startups and scaleups listed on the Dealroom database follow those criteria: rapidly scaling/scalable entities, maximum 20 years old, innovative by design and active in Luxembourg (headquarters, founding place, or a regular office).

As the database is collaborative, startups not currently listed are encouraged to create a profile to be included in future analyses.

As of July 2025, over 160+ startups leveraging AI technologies are active in Luxembourg, representing 22% of the national startup ecosystem. Notably, 75% of these AI startups are headquartered in Luxembourg, underscoring the country’s role as both a creator and adopter of AI innovation.

The number of AI startups has nearly doubled since 2020, reflecting the rapid integration of AI across sectors. This growth has accelerated in recent years, with a record 20 new AI startups launched in 2024 alone. These figures point to a young, fast-evolving ecosystem that is gaining momentum and maturity, driven by both local talent and supportive national strategies.

Figure 1: Number of AI startups in Luxembourg per creation year

Source of data: Dealroom

In terms of team size, most AI startups (45%) operate with small teams of 2 to 10 employees worldwide. This is typical for early-stage companies, allowing for agility and fast iteration. However, it also highlights common challenges such as limited resources and the need for specialized talent. These lean teams are laying the groundwork for future growth as the ecosystem matures.

Looking at global numbers, AI startups active in Luxembourg hire 3900+ people worldwide.

Figure 2: Percentage of Luxembourg AI startups per worldwide team size

Source of data: Dealroom

The Luxembourg AI startup ecosystem shows a strong concentration in enterprise software, which leads with 47 startups, followed by fintech (30) and health (24). This reflects the country’s strategic focus on B2B innovation, financial services, and digital health.

Notably, space tech also emerges as a significant niche with 15 startups, aligning with Luxembourg’s national investment in the space economy.

More detailed below – check our success stories cases.

Figure 3: Number of Luxembourg AI startups per industry

Source of data: Dealroom - A startup can be classified in up to 2 industries.

Nearly half (48%) of AI startups in Luxembourg have secured funding since their creation, with 26% raising at least €1 million. At the same time, 22% (35 startups) remain at the pre-seed stage, having raised less than €1 million, highlighting a healthy pipeline of early-stage ventures.

Among the funded startups, the average amount raised is €8 million, though the median stands at just €180k, reflecting a wide range of funding levels and a few large outliers.

In total, Luxembourg-based AI startups have attracted €2.1 billion in funding to date.

Figure 4: Percentage of Luxembourg AI startups per total funding range

Source of data: Dealroom

Over the past decade, enterprise software and fintech have led in terms of early-stage AI investment (Pre-Seed, Seed, Series A), followed closely by the space sector, a reflection of Luxembourg’s strategic positioning in both digital innovation and space technologies.

Figure 5: Early Stage Funding Allocation per Industries (in M€)

Source of data: Dealroom

Zooming in on 2025, 12 funding rounds involving AI startups have been recorded on Dealroom, totalling €45.9 million across all stages. So far this year, AI startups have captured 42% of total investment amount and accounted for 37% of all funding rounds i Luxembourg.

This is well above the European average, where AI startups represent 28% of VC funding in 2025, according to Dealroom’s latest AI briefing. Luxembourg’s higher share points to a strong national focus on AI innovation, likely driven by coordinated public and private efforts.

Historically, AI investment in Luxembourg peaked in 2020, declined in the following years, and has been steadily rebounding since 2023. This renewed momentum mirrors global trends in AI adoption and reflects the country’s commitment to building a data-driven, AI-enabled economy.

Figure 5: AI share of total funding in Luxembourg in terms of number of rounds and amount €

Source of data: Dealroom