Luxembourg AI ecosystem - Facts & Figures

Latest update: November 2025

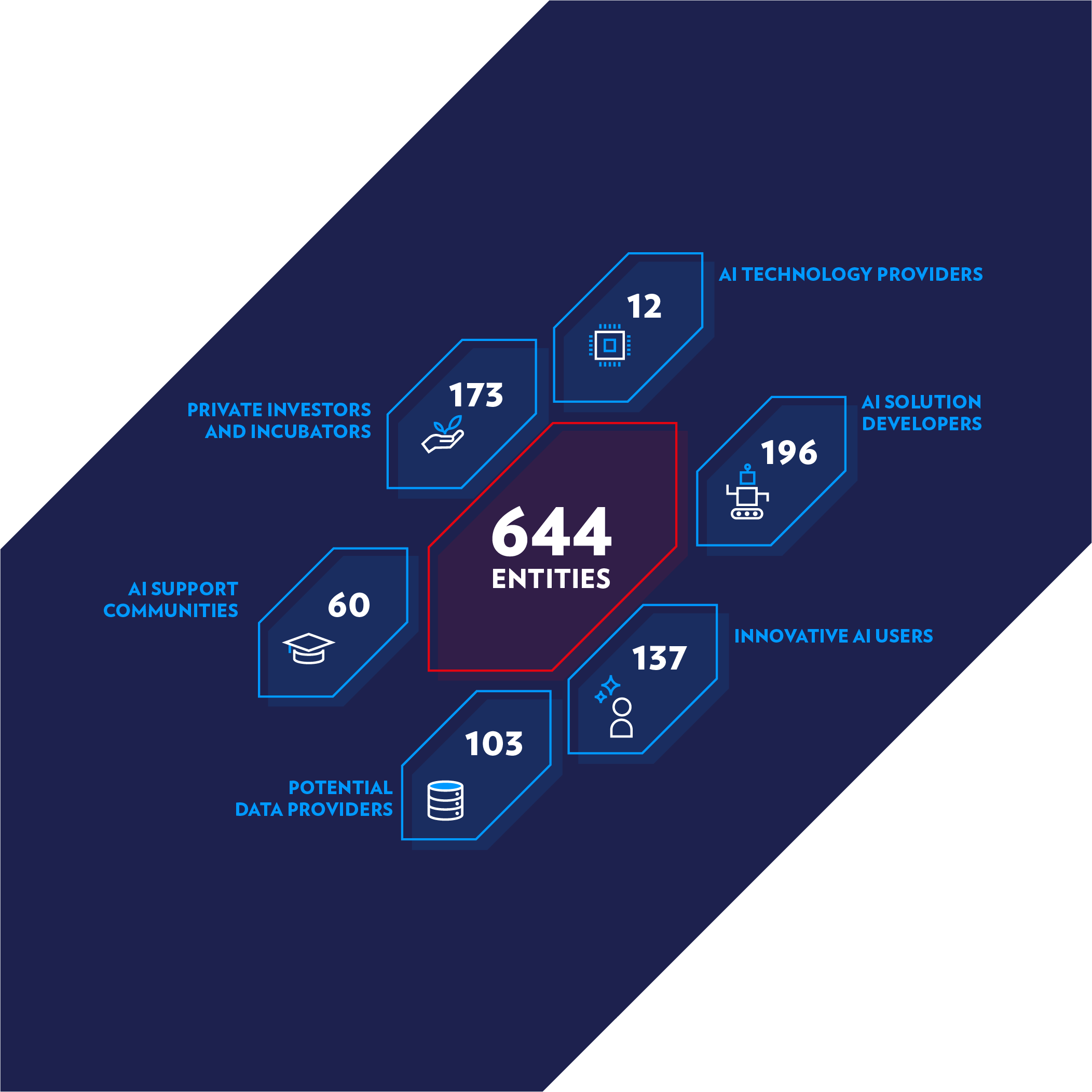

644 reasons to explore AI in Luxembourg

From startups to public organisations, Luxembourg’s AI ecosystem has gained momentum.

This AI Facts & Figures document presented here is derived from the 2025 version of the AI ecosystem mapping.

It breaks down the data behind the 644 mapped entities, giving you the context and insights to navigate the landscape with clarity.

A thriving and diverse AI ecosystem

Luxembourg's AI landscape encompasses 644 entities actively engaged across the entire AI value chain.

This includes technology providers, solution developers, innovative users, potential data holders, support communities and investors. This comprehensive ecosystem underscores Luxembourg's commitment to fostering AI innovation and collaboration across various sectors.

Figure 1: Numbers and categories of stakeholders shaping the Luxembourg AI ecosystem

Source of data: Luxinnovation (2025 Luxembourg Artificial Intelligence Ecosystem Mapping) N.B.: Some entities are included in more than one category where relevant.

Youthful and dynamic AI solution developers

The AI sector in Luxembourg is characterized by its youthful landscape. 85% of the AI solution developers are entities created less than 10 years ago.

This indicates a recent surge in AI entrepreneurship, reflecting the country's supportive environment. For the other 15% of entities created more than 10 years ago, this shows that developing AI solutions is a way to diversify the activity of more established businesses.

Figure 2: Percentage of Luxembourg AI solution developers according to age (since incorporation date)

Source of data: Luxinnovation (2025 Luxembourg Artificial Intelligence Ecosystem Mapping)

Sectoral focus reflecting national strengths

Almost half of the solutions providers target the IT & Cybersecurity and the Finance & Insurance sectors (26% and 18%, respectively).

Innovative AI users, organisations leveraging or preparing to leverage supercomputing or having received funding to develop innovative AI solutions projects, are especially active in industry, smart mobility and IT, confirming Luxembourg’s leadership in high-impact application areas.

Figure 3: Markets most frequently targeted by Luxembourg AI solution developers (percentage of entities)

Source of data: Luxinnovation (2025 Luxembourg Artificial Intelligence Ecosystem Mapping) N.B.: Some entities may target more than one market

Public data as a strategic enabler

Data is the fuel of AI, and Luxembourg boasts 103 potential data providers, primarily in the public sector. Nearly half (45%) of these entities are active in government and public administration, offering valuable structured and unstructured datasets.

Additional contributors operate across creative industries, health, mobility and education. These data sources, often accessible through platforms like the Luxembourg Open Data Portal, represent an essential asset for training AI models and building domain-specific applications.

They also complement European-level datasets, enhancing Luxembourg’s position within the broader EU AI ecosystem.

Figure 4: Percentage of potential data providers active in each sector.

Source of data: Luxinnovation (2025 Luxembourg Artificial Intelligence Ecosystem Mapping) and Luxembourg Open Data Portal N.B.: Some entities may target more than one market

Robust enabling community and investment landscape

The development of AI in Luxembourg is bolstered by a strong support system comprising consultancy firms (83% of enablers), academic and research institutions and a vibrant investment community.

The 173 Luxembourg entities identified in the private investors and incubators category complete the AI ecosystem by offering capital, resources and support. The selected organisations have listed artificial intelligence as one of their preferred sectors for investments in data bases (such as Pitchbook and Dealroom) and are ready to invest in AI tech companies all over the world.

While many of these investors have not yet invested in the national ecosystem, their location in Luxembourg offer opportunities to be further explored.

Figure 5: Categories of investors in the Luxembourg AI ecosystem (percentage of investors)

Source of data: Luxinnovation (2025 Luxembourg Artificial Intelligence Ecosystem Mapping), Dealroom and PitchBook

Luxembourg artificial intelligence ecosystem

Discover the full report and explore more takeaways from our AI ecosystem mapping analysis.