Luxembourg agri-food ecosystem - Facts & Figures

Last update: July 2025

Luxembourg agri-food value chain explained

Luxembourg’s agri-food sector is undergoing a quiet revolution. Behind every bottle of local wine, loaf of bread, or organic egg lies a complex network of small businesses and food innovators — all contributing to a more sustainable and resilient food system.

To support this transformation, Luxinnovation and the Ministry of Agriculture, Food and Viticulture have launched the first-ever data-driven mapping of Luxembourg’s Core Agri-business and Agri-enablers landscape. This interactive dashboard reveals who is active across the food value chain — from transformation to consumption — and how they shape the future of what we grow, eat, and export.

Explore the highlights below, then dive into the full dashboard.

Reminder of scope

This mapping provides a valuable overview of Luxembourg’s agri-food landscape including the Core Agri-business, i.e. private and public entities active in the agri-food value chain focusing on Transformation, Wholesale and Distribution, and Retail and Consumption, and the Agri-enablers, i.e. private and public entities that facilitate and support the efficient functioning and development of the agri-food ecosystem. The latter are divided into 7 categories: Product and Service Providers, Technology Providers, Research & Testing, Certification Organisations, Advisors & Consultants, Investors & Finance, Accelerators & Institutional enablers.

Main figures of the agri-food mapping

The agri-food mapping identifies 1,027 entities. Most (73%) operate directly in the value chain (Core Agri-business), while 27% are classified as Agri-enablers.

The largest group (365 entities, 36%) works across multiple food domains (Cross-sector).

The Beverages sector follows with 254 companies (25%), reflecting Luxembourg’s strong wine industry and numerous wine-related businesses.

Cereals & Grains ranks third with 145 companies (14%), mainly bakeries (52) and agricultural contractors (48) acting as Enablers.

The Livestock sector includes 108 entities (11%), featuring 56 butcheries as Core Agri-business and 42 Enablers involved in trading, breeding, or veterinary services.

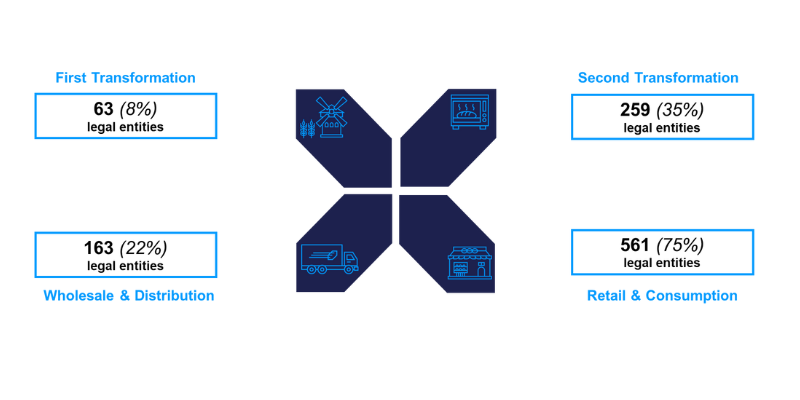

Figure 1: Distribution of Agri-business legal entities through the largest sectors

Source of data: Luxinnovation (2025 Luxembourg Agri-food Ecosystem Mapping)

Type of Agri-enablers

Among the 1,027 entities mapped inside the agri-food ecosystem, 280 legal entities were identified as Agri-enablers, i.e. entities that facilitate and support the efficient functioning and development of the agri-food ecosystem in Luxembourg.

They are divided into seven categories: Product & Service Providers, Technology Providers, Accelerators & Institutional Enablers, Advisors & Consultants, Investors & Finance, Research & Testing and Certification Organisations.

Nearly two-thirds of these Agri-enablers provide services or goods, while 40 technology providers develop and supply digital tools, automation systems, and precision agriculture technologies to the ecosystem.

Figure 2: Pourcentage of Agri-enablers by type

*Numbers do not necessarily sum up since entities can have multiple activities and tags.

Source of data: Luxinnovation (2025 Luxembourg Agri-food Ecosystem Mapping)

Distribution of the Core Agri-business on the value chain

Figure 3: Distribution of Core Agri-business entities on the value chain

*Numbers do not necessarily sum up since entities can have multiple activities and tags.

Source of data: Luxinnovation (2025 Luxembourg Agri-food Ecosystem Mapping)

75% of Agri-business legal entities are engaged in Retail and Consumption, highlighting a strong consumer-facing focus in the agri-food sector.

While 561 entities cater directly to end consumers through supermarkets and catering services, 63 handle First Transformation and 163 are involved in Wholesale and Distribution.

Meanwhile, 259 entities contribute to Second Transformation, turning semi-processed goods into finished products like bread or pastry.

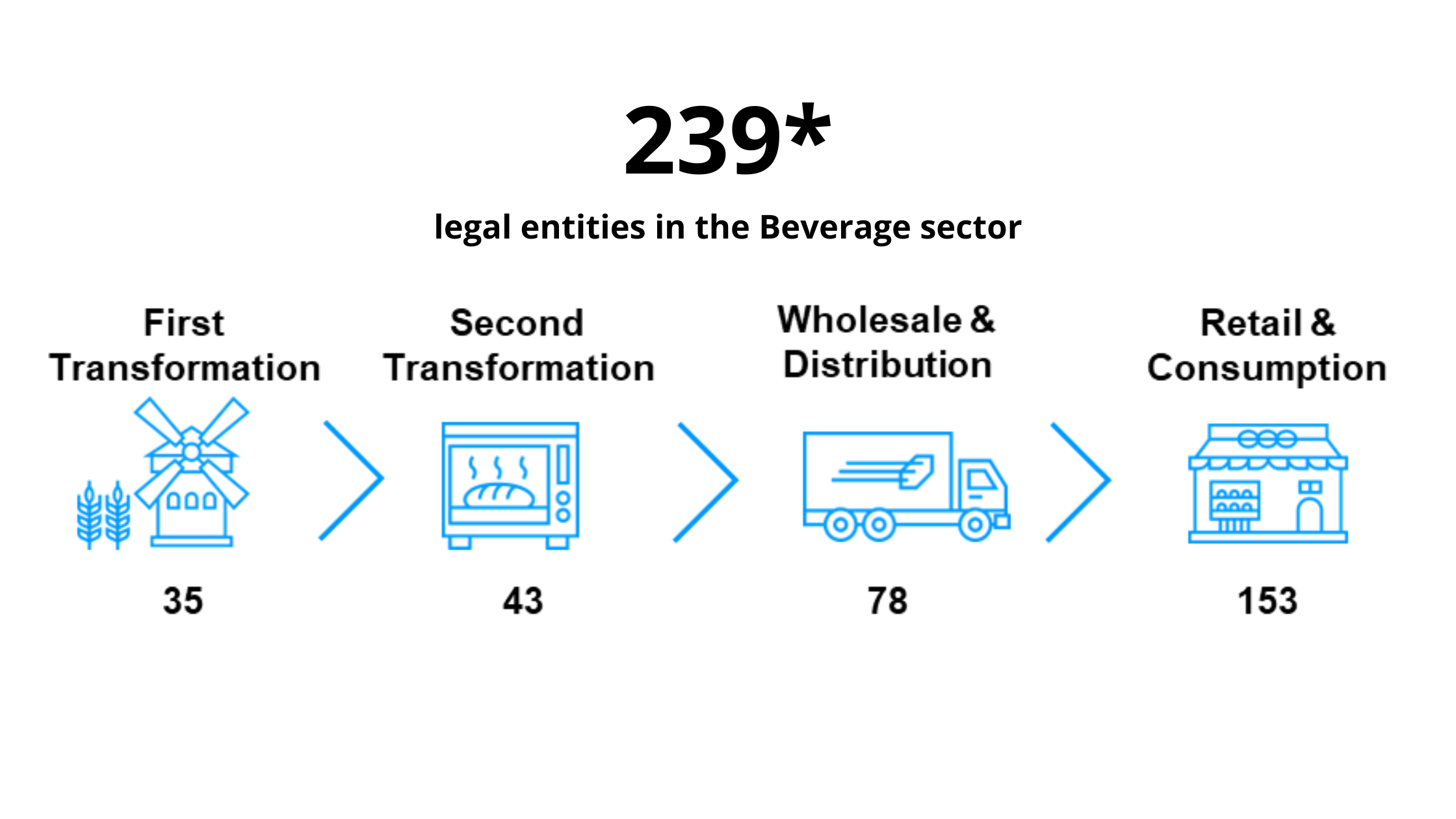

Focus on the Beverage sector

Nearly one-third (32%) of all Core Agri-business operate in the Beverage sector, with a strong focus on Retail and Consumption—153 out of 239 beverage entities are consumer-facing.

Notably, a large part of these entities are involved in wine-related activities, especially winemaking in the eastern cantons. The sector also includes companies specializing in spirits, coffee, beer, tea, and alcohol-free beverages.

Figure 4: Distribution of Core Agri-business legal entities through the Beverage value chain

*The total number of the agri-business entities in Beverage does not match the sum of the figures reported above because entities can operate at multiple steps of the agri-food value chain.

Source of data: Luxinnovation (2025 Luxembourg Agri-food Ecosystem Mapping)

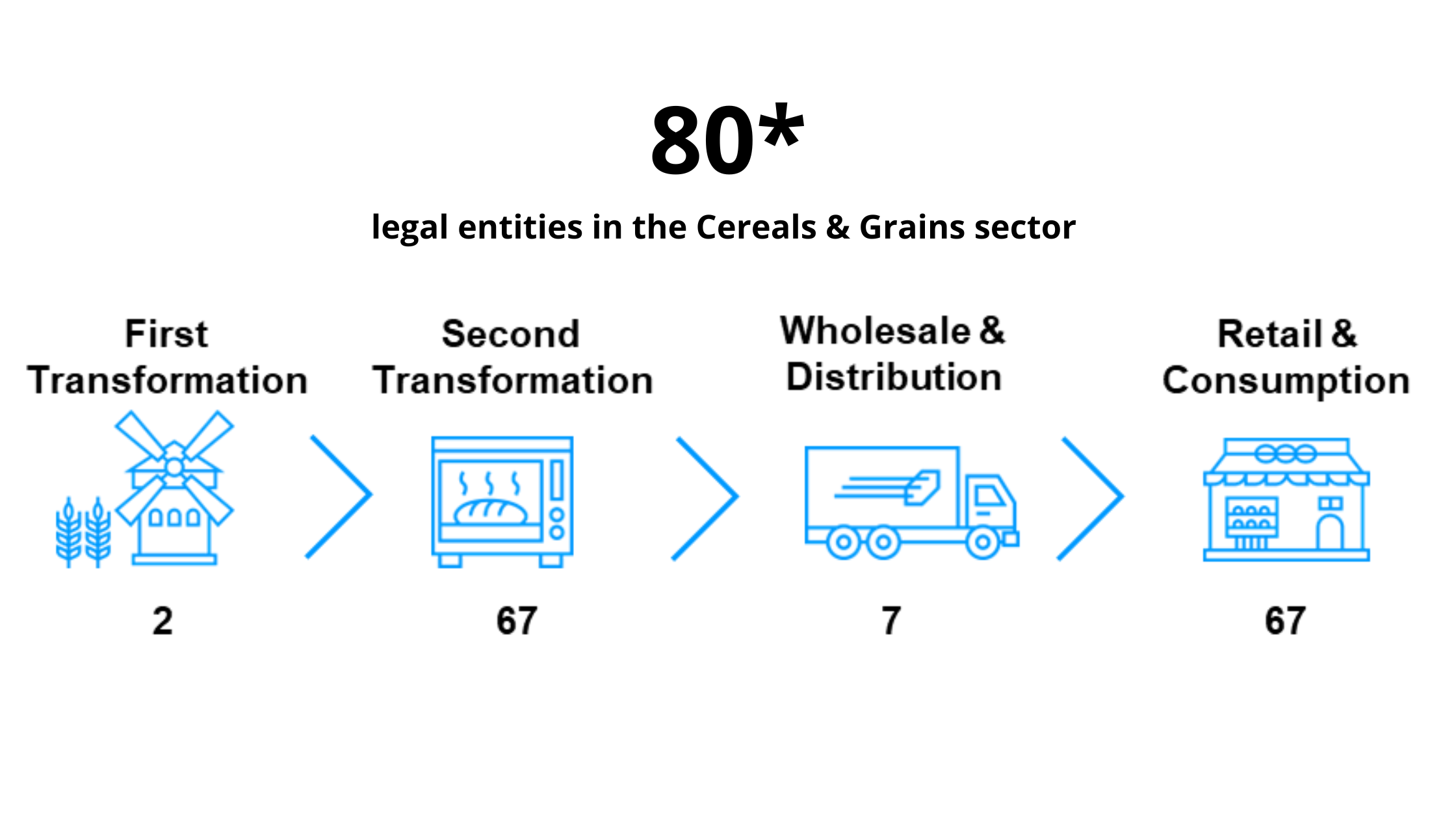

Focus on the Cereals & Grains sector

Figure 5: Distribution of Core Agri-business legal entities through the Cereals & Grains value chain

*The total number of the agri-business entities in Cereals & Grains does not match the sum of the figures reported above because entities can operate at multiple steps of the agri-food value chain.

Source of data: Luxinnovation (2025 Luxembourg Agri-food Ecosystem Mapping)

A total of 80 legal entities operate within the Cereals & Grains sector. As the present graph shows, there is an equivalence between companies in Second Transformation and those involved in Retail activities.

This equivalence partly comes from the 52 bakeries mapped, that sell their products directly to consumers.

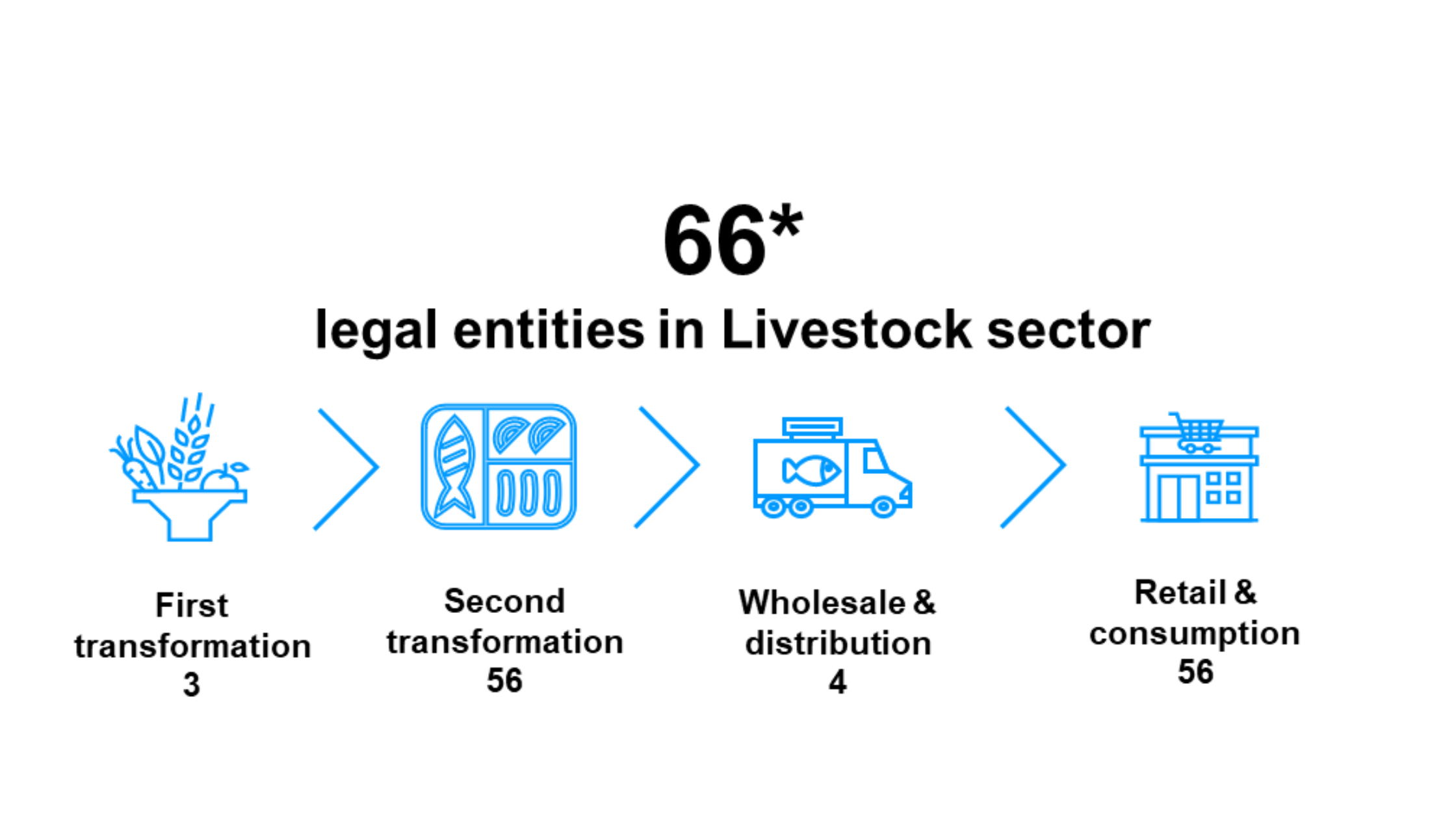

Focus on the Livestock sector

The Livestock sector comprises a total of 66 legal entities in Luxembourg, with an equivalence between the number of entities involved in Second Transformation and the number of entities involved in Retail and Consumption.

This equivalence can be explained by the high number of butcher shops, that prepare and sell directly their meat to consumers.

Despite the fact that there is only one slaughterhouse remaining in Luxembourg, three companies are involved in First Transformation, since this category also includes primal cutting.

Figure 6: Distribution of Core Agri-business legal entities through the Livestock value chain

*The total number of the agri-business entities in Livestock does not match the sum of the figures reported above because entities can operate at multiple steps of the agri-food value chain.

Source of data: Luxinnovation (2025 Luxembourg Agri-food Ecosystem Mapping)

.png)