Mindset matters: risk and vision in VC growth

Europe has the talent and capital to excel in venture capital, but structural changes are needed to unlock its full potential according to investor Jillian Manus.

Andrea Kuhfuss

Andrea Kuhfuss

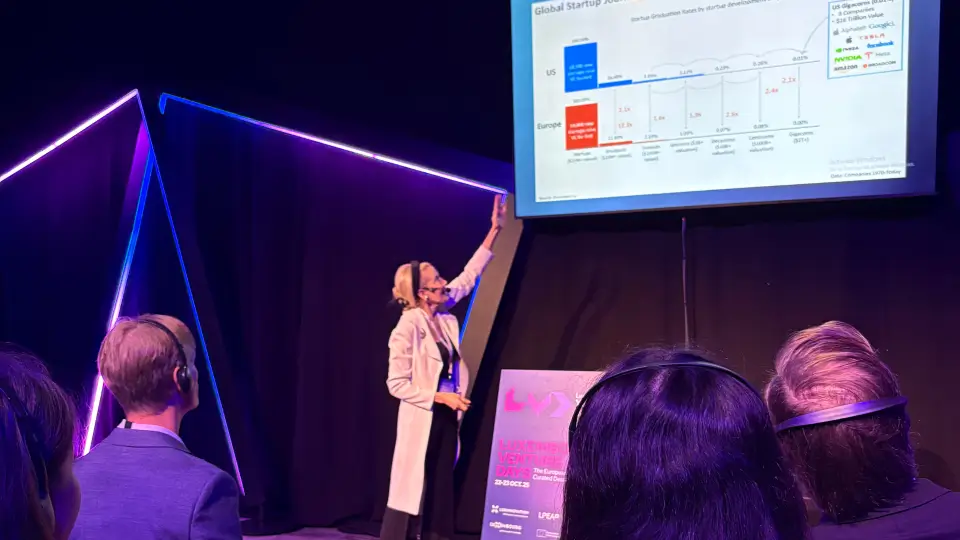

During her masterclass at Luxembourg Venture Days in October 2025, Jillian Manus drew a sharp contrast between how Europe and the United States approach venture capital investments.

Europe and the US have their own distinctive strengths, and they need to combine them.

Jillian Manus, Structure Capital

Based on her experience as Managing Partner of early-stage Silicon Valley venture fund Structure Capital, a US Venture Advisor for the European Innovation Council and a serial tech entrepreneur, she stressed that Europe has distinctive strengths, from strong operators to validated technologies. Combining these with US-style vision and risk tolerance would create a more powerful ecosystem.

Risk, failure and vision

She went on to explain that the perception of risk differs profoundly between the two regions. In Europe, venture capitalists tend to prioritise market validation and strong revenue streams, focusing on technologies that can be scaled with predictable outcomes.

In the United States, however, investors are more willing to bet on execution and vision even when metrics are not yet proven. Exceptional founding teams are often valued above the product itself, since the product will evolve, but the people behind it remain the constant. Failure is treated as a learning asset in the US, while in Europe it is still widely stigmatised.

I want founders who have failed, because they know what they should not do again. My own failure enabled me to teach other founders and become a better VC.

Jillian Manus, Structure Capital

This contrast shapes investment priorities: a revenue‑first mindset in Europe versus a growth‑first approach in the US. Where European investors often favour established operators, their American counterparts are more inclined to back mission‑driven thinkers and disruptive ideas.

Closing the capital and scaling gap

Ms Manus provided a range of data to illustrate her points. For example, Europe has invested €418 billion into venture capital over the past five years and created more than 350 unicorns. Now counting the highest level of VC‑backed technology companies in history, and with 3–5% of investors seeking exits, secondary volume is poised to surge. Yet liquidity remains limited and growth-stage funding gaps persist, particularly for rounds between €25 million and €200 million. Too few large-scale European funds are able to support startups ready to scale, leaving US capital to dominate this stage.

Pension reform could serve as a transformative lever according to Ms Manus. In the US, pension funds allocate 1–3% to venture capital, underpinning the industry. Europe invests around 80 times less. Allocating even 1% of European pension funds to venture capital would stimulate innovation without undue risk.

Solutions she presented include growing public fund-of-funds programmes to anchor larger VC funds, introducing matching schemes that double private capital, and ensuring efficient exit channels through mergers, acquisitions and IPOs. Tax incentives or carry rollover schemes could reward reinvestment, while EU-wide startup employment rules would reduce friction and boost talent access.

Building a holistic environment

Ms Manus underlined that Europe has all the prerequisites to succeed: talent, innovation and capital. What is missing is structural reform and a mindset shift.

Europe should catalogue its capabilities to attract international investors, accelerate procurement and startup adoption by corporates, and foster collaboration between government, academia and the private sector.

Anchor partnerships for design, validation and pilots would help startups scale faster. A performance-driven environment where successful exits recycle capital, talent and momentum into the next wave of innovation is essential.

I ask you to go to the edge and then I will push you and then you will fly. Jillian Manus, Structure Capital

Ms Manus closed her masterclass with this call to embrace risk. Europe does not lack opportunity, she argued, but it must dare to go to the edge.

Photo credit: Luxinnovation/Shine